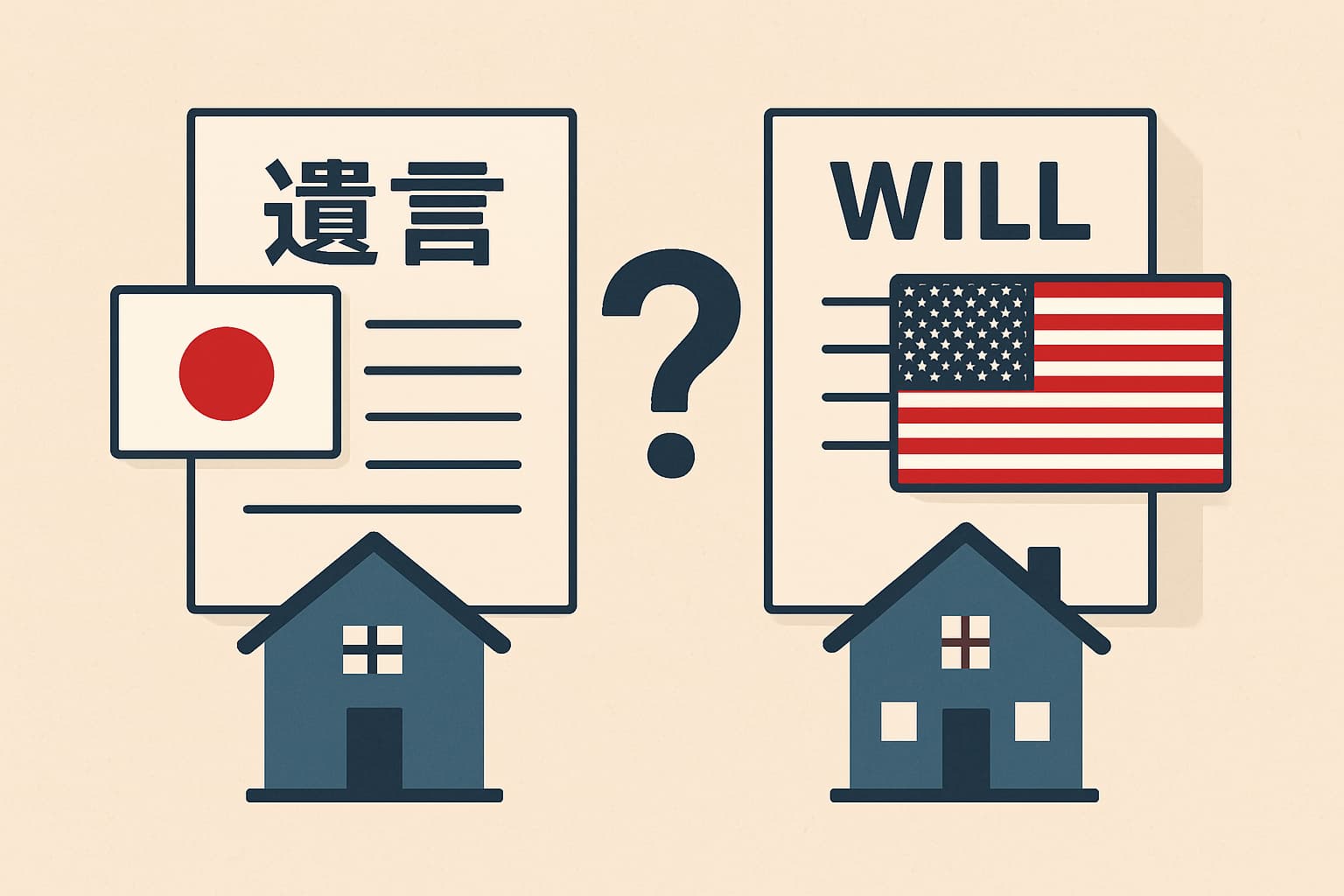

When a foreign national living in Japan, for example, a U.S. citizen, has assets in both countries, such as real estate and bank accounts , it is important to understand whether one will can cover all assets in both countries, or, whether a separate will for each country is needed.

Legally, it is possible to have one will that covers all of your global assets. However, for the example in the paragraph above, in practice, it would be better to have one will to cover the assets in Japan and another will to cover the assets in the U.S.

This blog explores the reasons why it is advisable to have a separate will for each country in which assets are located.

Different inheritance procedures in each country (probate vs. certification 'Kennin' )

In the U.S., the general administration of a deceased person’s will and/or estate is accomplished through a court procedure known as “probate”. The validity of the will is confirmed by the court and the court may appoint an executor, unless one has already been designated in the will. In contrast, in Japan, the inheritance commences almost automatically upon the death of the deceased, and generally no court procedures are required. However, procedures by a family court are required to “certify” the authenticity of a hand-written will ('Kennin').

If you try to handle the assets located in both countries with a single will, there is a risk that the probate procedure in the US will need to be certified in Japan and/or that the certification of the Japanese will be probated in the U.S. If you can only submit the original will to one place (i.e., either in Japan or in the U.S.) completing the procedure using a single will may result in a complicated and time-consuming procedure. On the other hand, if you have a will for each country covering the assets located in that country, you can carry out the two procedures in parallel in accordance with the procedures in each county. In that sense, two wills proceeding simultaneously will result in a much smoother inheritance process.

For example, if you only have an American-style will that was prepared in the U.S., you will also need to have it certified ('Kennin') in Japan. However, if you make a notarized will in Japan, you will be able to start the inheritance procedures immediately and pass on your property to your heirs without the need for certification ('Kennin').

Avoiding delays and risks of incompletion

Due to differences in different legal systems, there is a risk that wills made in one country will not be immediately understood or accepted, which will cause delays in the completing the necessary procedures. For example, when a U.S. court examines a will written in Japanese, in addition to translation, proof of validity under Japanese law may be required. The result is that inheritance procedures may be delayed.

Further, due to differences in legal systems, there may be certain provisions in a will that are not valid or enforceable in another country, even if the will is written. One typical example is a provision in a will made in the United States that attempts to include real estate in Japan in a trust set up in the U.S. This may not be possible under Japanese law since Japan’s trusts are quite different from that of a U.S. trust, and therefore may not be deemed to be a trust.

To avoid misunderstandings and the suspension of procedures, it is important to create a separate will whose contents is consistent with the laws and procedures in each country.

Can the executor of the will handle procedures for assets located in a foreign country?

For example, even if you make a will in the U.S. and appoint a U.S. citizen as the executor of that will, you need to know whether that executor will have the authority in Japan to take the necessary procedures with respect to assets located in Japan. The same concern arises in wills prepared in Japan involving assets located in the U.S.

If you have assets in both countries, it will be easier to execute your will if you appoint an executor in each country.

Conclusion: In practice, “one copy per country” is the safest option.

Although a single will can be used in rare cases, in reality, due to differences in legal systems, languages and procedures, there is a high possibility that the wishes of the deceased will not be fully realized with a single will alone.

If you make a separate will for each country that covers the assets in that country, the procedures can be carried out in accordance with the legal system of each country. This would make the distribution of the assets in the estate and name changes on bank accounts and real estate registration and the like to go much more smoothly and greatly reducing the burden on the bereaved family. In this case, it is also necessary to pay attention to the management of the content and dates so that the multiple wills do not contradict each other.

If you have assets in both Japan and the United States, we strongly recommend that you prepare a will that complies with the laws of each country, with the support of a legal professional who is familiar with international inheritance laws. Kobe Legal Partners has handled many consultations regarding wills from foreigners living in Japan and those living overseas. We would be happy to help you.

Wherever you are in the world

Contact Kobe Legal Partners

For those who live at a distance, we are happy to consult with you with our user-friendly Web-based meeting system.

We also welcome inquiries not only from the Kansai area (i.e., Osaka, Kobe and Kyoto), but also from other parts of Japan and overseas.