Do you have any of these concerns about inheritance procedures in Japan?

Your concerns

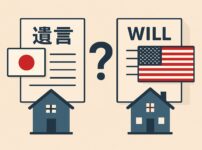

- You want to understand what the inheritance procedures are if you inherit assets in Japan from a non-Japanese national who has died

- You want to know what kind of documents you need to provide as an heir in inheritance proceedings involving the assets in Japan of a non-Japanese national

- You want to have someone take care of all the procedures necessary for a cash distribution of the inherited property (i.e., the estate of the deceased) among the heirs

- You want to take necessary procedures from outside Japan for inherited assets in Japan

- You want to take inheritance procedures for assets located outside Japan

- Disposal by sale of inherited real estate located in Japan

- Conversion to cash of inherited assets located in Japan, with cash remitted to the heir(s)

- Help consulting with foreign lawyers

How Kobe Legal Partners can help you

We can provide the following assistance with regard to inheritance matters involving a foreigner nationals:

- Researching foreign inheritance laws and international private law

- Collection of documents evidencing the inheritance

- Translation of foreign language documents

- Name change for real estate (inheritance registration)

- Inheritance procedures when the foreigner is the heir

- Inheritance procedures from overseas for assets located in Japan

Wherever you are in the world...

For those who live at a distance, we are happy to consult with you with our user-friendly Web-based meeting system.

We also welcome inquiries not only from the Kansai area (i.e., Osaka, Kobe and Kyoto), but also from other parts of Japan and overseas.